Climate change, soil health, and rural communities: why it’s time to invest in regenerative agriculture

In the millennia since humans first started cultivating crops and livestock, agriculture has provided us with food, shelter and livelihoods, and became one the world’s largest economic sectors. But along with this growth, food production has become a major driver of environmental concerns such as biodiversity loss, CO2 emissions, and water scarcity.

With global food demand set to increase 40% by 2050, the road ahead is a challenging one, but also one of many opportunities. In this article, the first of a series on the food and agriculture sector, its main players and key sustainable finance trends, I’m going to take a deep dive into regenerative agriculture practices and how to finance them.

Agrifood systems and future-proofing: the road ahead

Accounting for 26%of all global greenhouse gases emitted, lowering emissions has understandably been a focus of attention in the agricultural sector during recent years. But unlike other industries, which can easily substitute fossil fuels for renewable energy sources or decrease high supply chain emissions, the agricultural system is a complex and adaptive one that interconnects soil, weather, water, biodiversity, and social aspects.

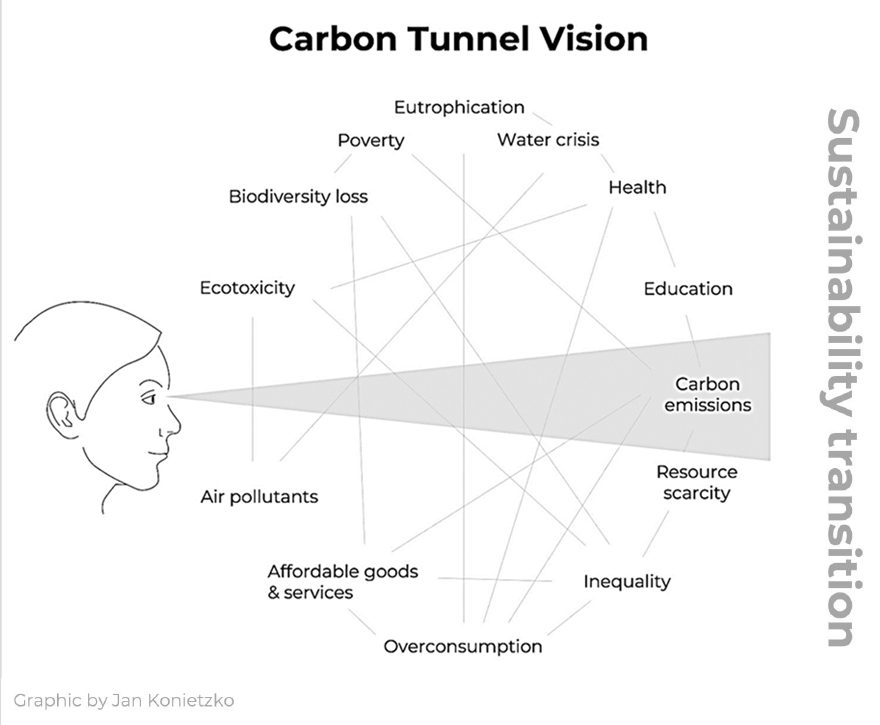

Could it be that, when it comes to agriculture, the climate tech sector is suffering from “carbon tunnel vision”, as Jan Konietzko of Cognizant termed it, neatly illustrating the complexity of sustainability transition and the key role that agriculture plays within it.

Regenerative agriculture: a (not so) new form of agriculture

In the past century, traditional agricultural practices emerged with good reasons and from good intentions. In order to sustain a growing global population, agricultural players explored the best approaches to enhance productivity, but this generally came at the expense of soil health. Industry developments included hydroponic culture in the Netherlands, advanced irrigation mechanisms pioneered in Israel, and the GMO revolution in the USA.

The objective was always the same: to increase efficiency and output. And it was achieved, for a while. But, as we’re now starting to realise, this “productivity at all costs” mindset has had a significantly negative impact on our environment, health, and social cohesion. However, since these negative externalities didn’t impact the price of the final product, they generally went unnoticed by everyone except farmers.

For instance, the the United States estimates that about 30%of all land globally is already degraded and about 12 million hectares of productive land — roughly three times the size of the Netherlands — is degraded every year. Moreover, 70% of freshwater withdrawals from rivers and groundwater is used in food and agricultural products.

But it’s not all doom and gloom: in recent years, regenerative agriculture has come to light as a solution to most of these problems. While the current narrative frames it as a new form of farming, it first came about several decades ago. Although the term “regenerative agriculture” was first used by the well-respected Rodale Institute in the 1980s, its practices existed long before this.

In essence, regenerative agriculture is a system of farming principles and practices which aim to regenerate and revitalise natural resources used in production. It consists of a series of land management practices designed to close the carbon cycle and build soil health. This in turn leads to improved ecosystem health, crop resiliency, and nutrient density, among other benefits. Regenerative practices include the use of diverse cover crops, no-till farming, multiple crop rotations, minimised use of herbicides, and avoidance of all types of pesticides, insecticides, and synthetic fertilisers.

Farms that implement these practices have exhibited increasingly healthier soil, increased biodiversity, and more resistant products. And this is not at the expense of the bottom line either: these practices often lead to increased profitability and resilience to climate shocks. Jeroen Klompe, a passionate 4th generation farmer at Klompe Landbouw, a regenerative farm in the Netherlands, showed me how they had increased potato yield production by 25% compared to traditional agriculture.

Adopting regenerative agriculture at large-scale would significantly mitigate climate change while also providing farmers with more economic and social benefits. A recent study by the Rodale Institutefound that on a large scale, regenerative agriculture could capture up to 40% of the world’s anthropogenic carbon emissions within 30 years.

But regenerative agriculture is not exactly the walk in the park that it seems.

Four key challenges

Although there’s no doubt that regenerative agriculture has great potential, there are still many challenges that need to be addressed before it can be adopted on a large scale.

-

No one size fits all

Although the set of practices is well understood, regenerative practices are highly tailored to local environments, making it a challenge to scale. Therefore, a key element to scaling regenerative agriculture is flexibility. Soil characteristics, type of farm and climate zones will lead to the use of different practices. As Stephanie Anderson puts it in her book, regenerative agriculture is a “one size fits none” model and how farmers will put this strategy in practice will differ according to their location, crops, goals and community needs.

-

Clear and flexible standardisation

However, the fact that regenerative agriculture is highly tailored doesn’t mean there is no space for standardisation. There’s currently no clear definition or framework that can be applied at both a global and local level. Farmers and food companies need clarity on which measures they should apply to each crop.

The SAI Platform launched the Regenerative Agriculture Programme in 2023, aiming to be a “single, trusted and cost-effective way to apply regenerative agriculture principles worldwide, supporting farmers and protecting nature”.

Key to its success will be ensuring that this standard is more flexible and easier to apply than the organic certification. Although the EU organic regulation protocol started with 10 pages, the latest edition numbered 92 pages of articles and norms to be followed. Unsurprisingly, 23 years after the EU first released an organic norm, less than 4% of agricultural land in Europe is certified organic. Certification levels the playing field and builds trust with consumers but it is simply part of the journey, not the end goal.

-

Lack of information and support

Few farmers have fully implemented regenerative agriculture practices and even fewer are in a position to advise on the best way to go about it.

Technology can help farmers by providing them with data-driven insights into their crops, soils, and ecosystems. It can also connect them with other farmers and experts that can offer support and advice.

One company already supporting farmers making the transition is Soil Heroes, which carries out baseline physical soil measurement to help them understand the health of their soil. The platform can then monitor advancements in farming practices and reward farmers for improving soil health and achieving other environmental benefits. Rewards could include selling carbon insetting and offsetting or access to lower interest rates with banks.

Klim, a German based company, is building an ecosystem marketplace for regenerative agriculture where farmers can document their environmental and climate protection achievements and get paid for them. Recently, Klim raised €6.5 million to scale its platform internationally from top investors including Agfunder, Edaphon and Green Generation Fund.

These two companies are following in the footsteps of pioneers Regrow, a measurement, reporting and verification (MRV) company that has analysed over 80 million hectares and is active in 45 countries.

This type of data will be critical to building awareness and trust with the final consumer. By providing an accepted, trustworthy basis for understanding what impact actions taken within the supply chain can have, these platforms play an important role.

-

Financial obstacles

Finally, there are also significant financial obstacles to implementing regenerative agriculture.

Upfront costs can be high because farmers often need to make significant changes to the way they operate. This might include changes in equipment, seed varieties, and farming practices. In some cases, farmers may also need to rethink their entire business model. It’s not unusual for farmers to adapt their tractors and machines to the new methods, which comes at a high cost.

Coupled with this, the relatively high cost of land and low profit margins in agriculture mean that potential returns from pure farmland investments tend to be modest. In the Netherlands, for example, a hectare of land costs approximately €70,000 (the highest in Europe), making it hard for farmers and investors to achieve high returns over the long term.

Lastly, farmers are often held responsible for the majority of the negative impact that the food system has on the environment, yet they do not make their decisions independently. Growers’ decisions and choices are influenced by many stakeholders, including food companies, retailers, consumers, politicians, and regulators.

As a result, it is also relatively common for farmers to opt to cut out the middleman and sell directly to consumers or focus on niche markets. While the direct-to-consumer (D2C) model can generate higher prices, it is more complex, requiring farmers to handle distribution and marketing costs. Additionally, avoiding doing business with large food players will limit regenerative products’ ability to reach the mass consumer market.

Growing money on trees: financing regenerative agriculture

The high upfront costs can make it difficult for farmers to implement regenerative agriculture, especially if they’re already struggling to make a profit. However, there are a number of funding options for farmers who want to make the switch and other stakeholders in the value chain that want to support the transition.

Specific finance plans should be based on local needs, capacities, resources, and objectives, and the end goal should be to achieve socio-economic and environmental objectives together with financial returns. Finance instruments should be regarded as tools to help farmers get there, rather than the end goal itself.

-

New funding opportunities

To help farms manage the high cost of land and profit margins, Kempen SDG Farmland invests in farmlands and agricultural properties to support sustainable and regenerative agriculture. Real assets provide some of the most direct forms of investing in regenerative agriculture through ownership of farmland and a low correlation with other asset classes. Kempen has a long term fund (10+ years) with an inflation hedge component.

Private equity and venture capital funds also provide financial support and tend to focus their investments in the “tech enablers” of the value chain, where the investment cycle is shorter and there is a higher possibility of returns. These companies play an important role, addressing a variety of challenges including farm inputs, logistics, ingredients, finance, and insurance.

One of these is Tikehau Capital, which has recently launched a new private equity fund dedicated to investing in projects and companies helping to scale-up the transition to regenerative agriculture. This fund has introduced a new structure to the market, offering a lifetime of 15+3 years instead of the usual 10+2 years. This grants added flexibility to this nascent industry.

Triodos Organic Growth Fundoffers investors a private equity portfolio of companies leading the transition to a more sustainable economy in the Netherlands and Europe.

Another option is a blended finance approach, but such mechanisms are often complex and require significant upfront funding and de-risking during the initial period, including the use of guarantees. One interesting initiative by &Green provides its clients with greater flexibility than traditional lenders by offering long-term financial support and subordinated debt.

The EU Farm to Fork strategy is also promoting carbon farming as a new green business model and will soon develop a new set of regulatory framework. I’ll write a detailed report on this topic in the coming weeks.

-

New sources of revenue

Recently, new schemes to monetise ecosystem services such as carbon offsets and insets have surged. These could provide farmers with additional revenue; however they are not that easy to implement and results for now remain marginal.

A carbon credit transaction is complex and demands time and capital from the farmers. The typical process goes something like this: first, the farmer needs to select a protocol for soil carbon sequestration, then they need to submit the project to the carbon registry. If accepted, the farmer will implement the practices and, once the carbon is sequestered (which can take years), they need to hire (and pay) a third party to verify the amount sequestered, issue the carbon credit and, finally, sell it at the voluntary market.

There are structural obstacles to scaling this process and is not yet financially attractive to farmers. Below I outline a number of factors that have impeded the popularity of soil carbon as a credit.

- The timing of the cash flow does not match the farmer’s needs. Revenue from selling carbon arrives years after the farmer implements the practices. Soil carbon projects need long-term dedication, and the starting expenses might be substantial. This combination often makes it unfeasible.

- Unlike credits from forestry projects, which have a relatively well-developed set of measurement protocols, soil carbon sequestration credits do not yet have a widely accepted standardised protocol. As noted by Ivana Gazibara, verification standards are still a fundamental barrier to scaling up soil carbon projects as “more than a dozen protocols exist, and they vary across key dimensions like scientific rigour, additionality, and durability.”

- Due to its high implementation costs, scale plays an important role in this market. The most successful projects have been carried out on farms larger than 1,000 ha, mainly in Australia and the United States. In Europe, where land holdings are smaller, the economics become harder. In the Netherlands, the average farm is around 40 hectares.

It is still too early to know whether carbon offsets will play a relevant role in the agricultural sector. However, companies such as Nori are building innovative business models and trying to disrupt the sector.

- Value chain development

“Carbon insetting”, the new kid on the block, is when companies promote sustainable practices and invest in their own value chain to reduce their emissions (normally Scope 3). In this strategy, businesses invest in the ecosystems that their suppliers depend on by increasing their resiliency. In the agricultural world, this can be translated into large food companies investing in farmers to help them adopt regenerative practices. And this is exactly what is happening.

Large food companies have made commitments to carbon neutrality and are increasingly welcoming the adoption of regenerative agriculture. Numerous large companies including Nestlé, Unilever and Cargill have announced significant investment in the value chain to develop this practice. Not only will their procurement teams be able to influence agricultural practices in the areas they source from, they’ll also be able to invest in companies already occupying the regenerative agriculture sector. They’ll also be able to guarantee or de-risk investments for the farmers through innovative off-take agreements.

It’s not yet clear which initiatives are genuine, which will work and which are just trying to take advantage of the growth in consumer demand for sustainably labelled food, but they certainly won’t be the last.

I hope to see an increasing amount of investment flowing from down to upstream in the agricultural value chain. This will also increase transactions in the space as startups leveraging these trends gain scale and get on the radar of large food companies.

The future has just begun

Regenerative agriculture is a key piece of the puzzle in mitigating climate change, improving soil health, and supporting rural communities. However, as we’ve discussed, the challenge now is to finance and incentivise the widespread adoption of these practices.

At a time when farmers, entrepreneurs, and businesses are responding to growing demand for a more transparent and sustainable Agri & Nature-Based Solutions (NBS) value chain, investors have a critical role to play in financing these opportunities.

At Sustainable Capital Group, we’re firmly committed to accelerating this transition and are working with companies and investors on how to deploy regenerative agriculture at scale.

In the coming weeks, I’ll be writing more articles addressing the characteristics of the main sectors in the field, their main players, and the key trends in financing the transition to a more sustainable food and agriculture system.

Ps. If you’re a farmer, investor or new to the industry and keen to learn more, then I strongly recommend listening to the Investing in Regenerative Agriculture podcast with Koen van Seijen who holds in-depth conversations with leading companies and thought leaders within the industry.

About Sustainable Capital Group

At Sustainable Capital Group, we partner with leading companies that are addressing the world’s greatest challenges across food and agriculture. By focusing on the entire Agri & NBS supply chain, we support our clients with a holistic view that encompasses environmental and financial impact.

Are you looking for opportunities or to fundraise in this space? Is there a topic that you’d like me to explore in future articles? Connect with me on LinkedIn or simply fill out our contact form. I’d love to find out more about what you’re working on.