ESG & Materiality: The maps to navigating Sustainable Finance

The world of sustainable finance is a complex terrain, which can often be unraveled with three simple letters: E, S, and G. These letters stand for Environmental, Social, and Governance, forming the core pillars of sustainability. More and more, investors are using ESG considerations to screen potential investments. That is why it is crucially important to understand why and how ESG applies to your business.

Related to the notion of ESG is Materiality, which is all about identifying which ESG factors are the most important to your company. In this blog, we’ll explore the significance of ESG and dive into the pivotal concept of materiality within the context of sustainable finance.

What is ESG?

ESG, which stands for Environmental, Social, and Governance, is a set of criteria used to simplify the evaluation of a company’s or investment’s impact on sustainability and ethical practices. In the context of sustainable finance, ESG plays a decisive role as it represents the key factors that investors and financial institutions consider when assessing the sustainability and ethical implications of their investments.

Why is ESG important for companies?

ESG factors are important because of their ability to mitigate risks, promote long-term sustainability, align investments with ethical values, ensure regulatory compliance, provide a competitive edge, offer access to sustainable capital, and foster robust stakeholder engagement. As the sustainable finance landscape evolves, understanding and integrating ESG criteria are essential for investors, financial institutions, and companies to make informed decisions that balance financial returns with positive environmental and social impacts.

What ESG data to collect?

Here we provide examples of factors relating to each of the three pillars.

Environmental (E): This pillar encompasses everything related to our planet and its ecosystems. Think of:

- Carbon emissions

- Resource usage

- Habitat preservation

- Biodiversity

- Waste management

These metrics evaluate how a company’s activities impact the natural world.

Social (S): The “S” focuses on people and communities, making it one of the most challenging aspects to measure. It applies to both people working at the company and people affected by it, all possible stakeholders, and considers factors such as:

- Employee treatment

- Health and safety standards

- Fair pay

- Human rights

- Community engagement

Social responsibility also extends to a company’s supply chain and its commitment to safeguarding human rights.

Governance (G): Governance deals with leadership and decision-making within organisations. It assesses issues like:

- Shareholder rights

- Board diversity

- Executive compensation

- Adherence to anti-corruption practices

- Risk management

Good governance ensures that a company operates ethically and transparently.

While this ESG framework simplifies sustainability, it’s essential to remember that sustainability is an intricate concept with both qualitative and quantitative impacts. Nevertheless, ESG serves as a practical guide for decision-making in a complex landscape.

ESG Risks and Compliance

It’s important to note that there isn’t a specific regulation solely dedicated to “ESG.” Instead, ESG serves as a corporate framework to streamline the complexities of sustainability. However, it closely aligns with the Corporate Social Responsibility Directive (CSRD) enforced by the EU. The CSRD mandates large and listed companies to report on their environmental and social activities, emphasising the growing importance of ESG considerations.

Navigating ESG Data and Reporting

The challenge lies in the plethora of Key Performance Indicators (KPIs) available for measuring ESG aspects. Compounding the issue, various measurement methodologies exist, further complicating the landscape. ESG reporting demands a blend of qualitative and quantitative measures and should involve input from multiple stakeholders.

The good news is that not all ESG metrics are relevant to every organisation. This is where materiality assessment plays a crucial role.

What is Materiality?

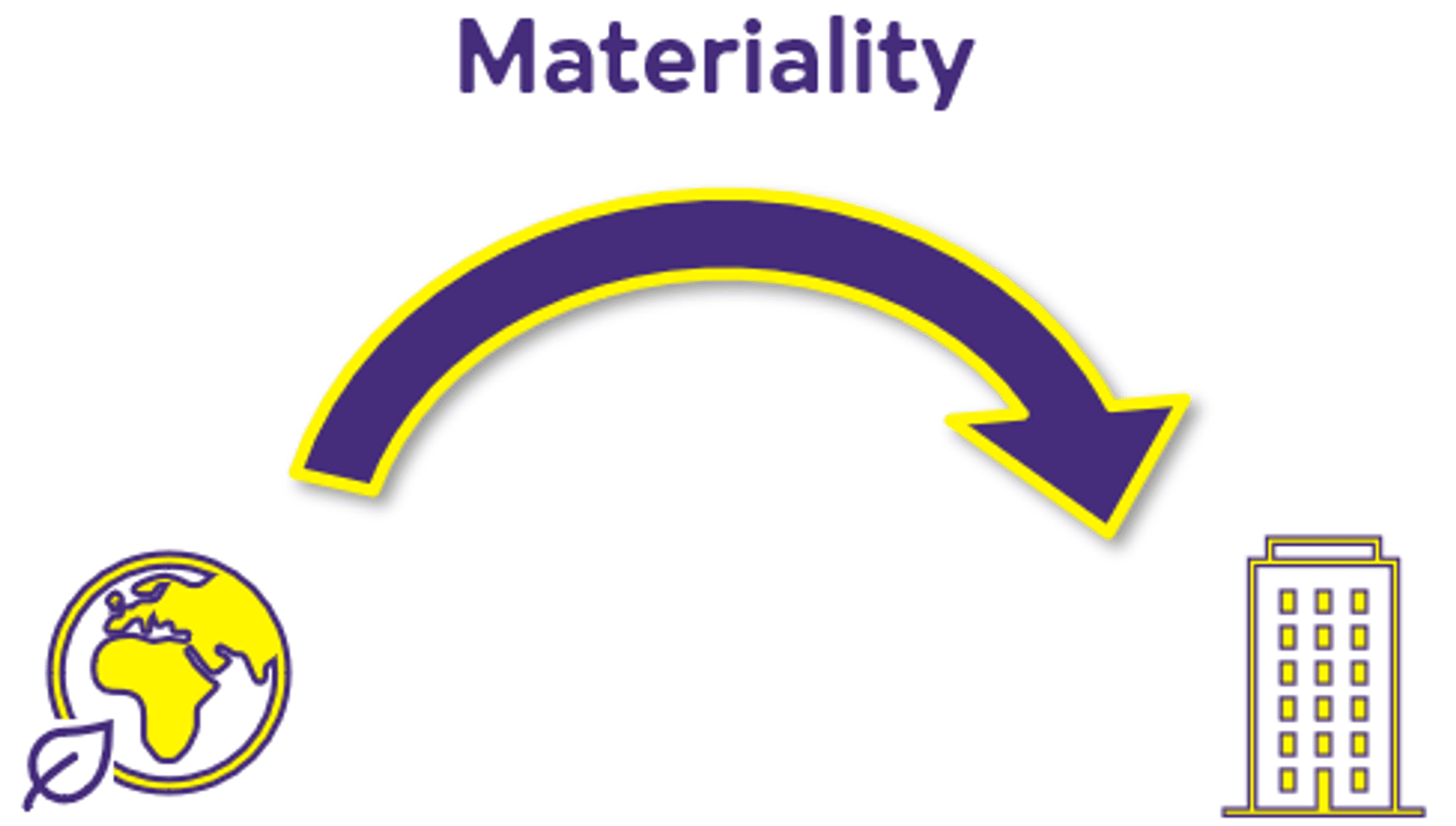

Materiality refers to the ESG aspects that have the most significant influence on a company’s operations and the decisions made by stakeholders. In essence, it identifies which ESG activities could have a substantial financial impact. To determine materiality, organisations conduct materiality assessments.

How to assess Materiality?

One valuable resource for assessing materiality is the SASB Materiality Map, which highlights typical materiality topics for various sectors. While this provides a starting point, conducting an organisation-specific materiality assessment asking questions to various diverse stakeholders of the business is crucial. Ask questions like, “Which E, S, and G topics matter most to our business?”

A holistic way to assess this would be to follow these 6 steps:

- Identify relevant ESG issues

- Complete an impact assessment of each issue

- Engage stakeholders to gather their perspectives on the ESG issues

- Prioritise issues from most to least important

- Report on & integrate issues

- Implement ongoing monitoring

However, traditional materiality primarily focuses on how sustainability issues create risks and potential negative financial consequences due to a company’s activities. It often overlooks how a company impacts sustainability issues—an area where “Double Materiality” comes into play.

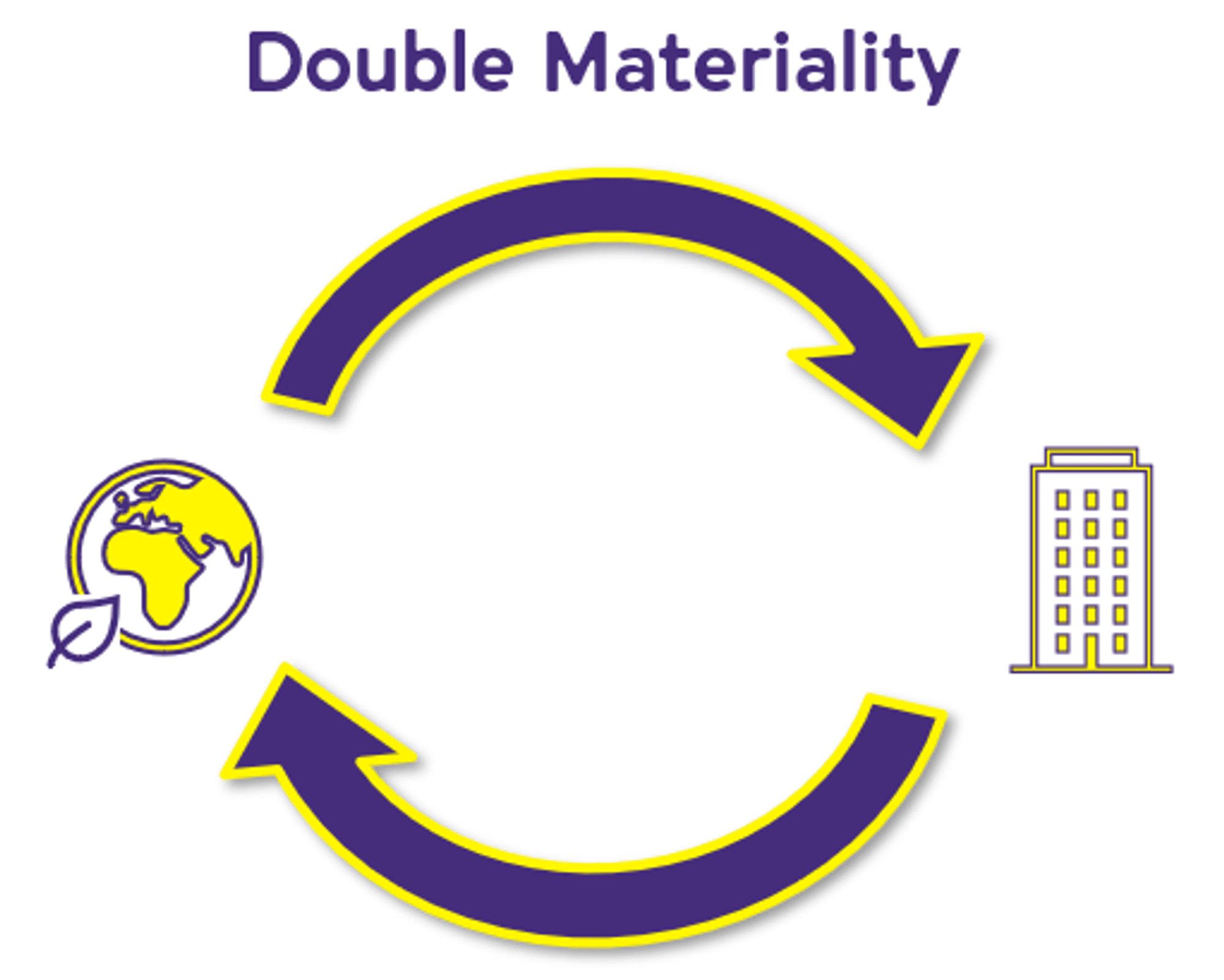

What is Double Materiality?

Double materiality goes a step further by asking, “How does a company impact the planet and its people?” This approach places responsibility on organisations for the actual and potential adverse impacts of their business activities on the environment and society. It aligns with the EU Taxonomy’s principle of “do no significant harm.”

Let’s give a practical example to understand the differences between a materiality and double-materiality assessment:

Example of a materiality assessment

Company A is a manufacturing company that is focused on reducing its operational costs. To conduct a materiality assessment, they identify key environmental, social, and governance (ESG) aspects that could significantly affect their business operations. After consulting with their internal teams and some external stakeholders, they narrow down their focus areas to three issues: reducing water usage, minimising energy consumption, and ensuring employee safety.

The materiality assessment helps Company A prioritise these ESG aspects based on their potential financial impact and relevance to the business. As a result, they implement energy-efficient equipment and safety measures in their factories, which reduces operational costs, enhances worker safety, and improves their environmental footprint.

Example of a double-materiality assessment

Company B is a global tech conglomerate with a significant impact on society and the environment. They understand that their operations affect not only their financial performance but also the broader community and ecosystems. In addition to a traditional materiality assessment, they conduct a double materiality assessment.

For the traditional materiality assessment, Company B identifies ESG risks that could affect their financial performance. They prioritise issues such as data security, supply chain resilience, and regulatory compliance. These aspects are crucial for maintaining their market position and profitability, as well as their reputation and license-to-operate.

In the double materiality assessment, Company B extends its focus beyond financial risks. They engage with external stakeholders, including environmental organisations and human rights advocates, to understand how their operations impact the planet and society. This assessment reveals that their manufacturing processes contribute to significant carbon emissions and that their supply chain practices sometimes involve labor rights violations.

As a result, Company B takes comprehensive action. They not only invest in sustainable manufacturing practices to reduce emissions but also work closely with their suppliers to improve labor conditions. Additionally, they initiate community outreach programs to address societal challenges caused by their operations.

Sustainable Finance Explained: CSRD's double-materiality

Materiality vs. double-materiality

The double materiality assessment prompts Company B to take comprehensive action beyond financial considerations. They invest in sustainable manufacturing practices to reduce emissions, collaborate with suppliers to improve labor conditions, and initiate community outreach programs to address societal challenges stemming from their operations. In this way, Company B’s approach recognises their broader responsibility, benefiting not only their business but also the world they operate in.

The Importance of ESG and Materiality in Financing

In today’s financial landscape, ESG considerations are critical to nearly every investor. ESG acts as the initial screening process for many investors, determining whether a potential investment aligns with their sustainability goals. Investors’ approaches to ESG vary, from a simple checkbox indicating alignment to comprehensive frameworks.

Attract investors

Having a robust ESG analysis and considering materiality topics can help you attract investors who share your values and sustainability objectives. Additionally, investors will soon be obligated to report on their own ESG impact, thanks to the SFDR Regulations. Having your ESG focus areas and data in order can simplify their reporting processes, making them more eager to invest in your company.

Most favourable terms for transaction

Furthermore, embracing ESG practices may open doors to more favourable financing terms. The rise of sustainability-linked financing instruments embeds ESG KPIs into financial structures. By having your ESG metrics ready, you position your organisation to access such instruments, potentially securing financing with the most favourable terms.

Conclusion

In conclusion, ESG and materiality are integral components of sustainable finance. Understanding the nuances of ESG, conducting materiality assessments, and embracing these principles not only aligns your organisation with sustainability goals but also positions you for success in a financial landscape increasingly shaped by ESG considerations. As the sustainability journey unfolds, ESG and materiality will continue to play pivotal roles in the world of finance.

Any questions?

At Sustainable Capital Group, we understand the complexities of EU regulations in sustainable finance, and our sector experts are here to assist you. For personalised guidance, simply fill out our contact form, and we’ll be in touch with you shortly.