How to structure sustainability-linked loans: The ultimate guide

Sustainability-linked loans (SLLs) are a relatively new financial instrument in the realm of sustainable investments. In simple terms, these are loans where the interest rates change, depending on how well the borrower does in terms of sustainability. As investors increasingly prioritise ESG factors in their investment decisions, SLLs offer an effective way for companies to access capital while demonstrating their commitment to sustainability. In this blog, we aim to explain the guiding principles behind this important development in sustainable investing.

What are sustainability-linked loans?

Sustainability-linked loans (SLLs) are financial instruments that encourage borrowers to meet specific sustainability performance objectives, such as reducing their carbon footprint, increasing energy efficiency, or promoting diversity. These loans typically align with investors’ ESG goals, incentivising borrowers to commit to environmental, social, and governance principles. The inclusion of margin ratchets, explained below, reassure investors that their investments drive real change.

Margin ratchets to promote eco-friendly practices

Margin ratchets are a pivotal feature in SLLs, serving as an incentive for borrowers to meet sustainability targets. These mechanisms adjust interest rates based on sustainability performances in two ways: A step-down or step-up. A step-down leads to lower interest rates as a reward when sustainability targets are met, encouraging borrowers to prioritize sustainability. Conversely, a step-up increases interest rates when targets aren’t achieved, creating a financial consequence for insufficient sustainability efforts.

Margin ratchets in facts & numbers

Research conducted by us, Sustainable Capital Group, reveals that margin ratchets within sustainability-linked loans often comprise both incentives and consequences. This means that when borrowers successfully meet sustainability targets, they enjoy a decrease in the interest rate. However, if they fall short, the interest rate increases as a penalty.

Interestingly, many investors prefer margin step-ups over step-downs due to the belief that they shouldn’t bear the cost of sustainability improvements. While this approach still provides the necessary financial incentives, our measurement of these margin adjustments indicates that the average margin premium/discount remains less than 1%.

To bolster sustainability, borrowers can take SLLs a step further by directing the saved or earned funds from the premium/discount towards additional eco-friendly initiatives or charitable causes.

The choice between a step-down or step-up is primarily determined by key performance indicators (KPIs), which play a vital role in this process and are explained in the next section.

Sustainable Finance Explained: Sustainability-linked loans

KPIs are key to structure sustainability-linked loans

Sustainability-linked loans are typically structured with interest rates that vary based on whether the borrower successfully meets predefined sustainability Key Performance Indicators (KPIs). KPIs serve as measurable benchmarks for sustainability performance. Borrowers and lenders typically select 2-3 quantitative sustainability KPIs and agree on future targets to be achieved within the loan’s tenor.

What makes a good sustainability KPI?

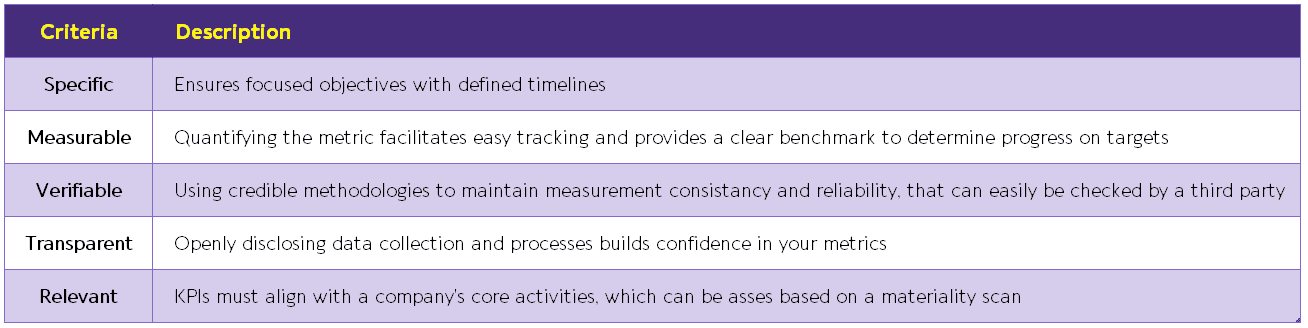

To really create the perfect KPI to measure sustainability performance, it is necessary that the measurement possesses the following attributes:

The borrowers typically work with independent third-party advisors for verification of their performance against the KPIs, which adds credibility and transparency to the process. This not only provides assurance to the lender but also reassures investors that their funds are contributing to genuine sustainability improvements.

Set targets

After setting KPIs, setting corresponding targets is a critical step in structuring sustainability-linked loans. Striking the right balance between ambition and achievability is paramount. Targets should be challenging enough to drive sustainability improvements, but also realistic to ensure they can be met. Additionally, aligning these targets with the preferences of investors is essential. It’s vital to consider what matches the appetite of investors, as their confidence in the targets can significantly impact the success of ultimately receiving the loan.

One valuable strategy is benchmarking: comparing your KPIs and targets to industry peers in the same sector. This not only provides a relative measure of your sustainability goals but also offers insight into what is feasible and competitive within your specific industry. In this way, targets become a tool for continuous improvement while simultaneously enhancing your attractiveness to ESG-oriented investors compared to the alternatives.

Data collection: The key to KPI measurement

To effectively implement and monitor SLLs, a robust data collection and reporting process is essential. This process involves several key elements:

-

Historic Data Collection: Ideally, companies should collect historical data related to the selected KPIs. This historical data helps establish a clear trajectory of performance and sustainability progress. By understanding past performance, it becomes easier to set meaningful and achievable targets.

-

Ongoing Data Collection: After the loan agreement, continuous and consistent data collection is imperative to track progress effectively. Typically, data is collected on an annual basis, but in cases where a company is making rapid progress, more frequent data collection may be necessary and preferable.

-

Borrower’s Reporting: The borrower, or the company receiving the loan, must report their own data on the progress of their KPIs. This reporting is vital for transparency and accountability. It allows both the lender and the borrower to monitor performance and adherence to the agreed-upon sustainability targets.

-

Independent Third-Party Advisor: To ensure the accuracy and credibility of the data and performance verification, it’s advisable for the borrower to engage an independent third-party advisor. This advisor can objectively assess and verify the company’s sustainability performance, adding an extra layer of confidence for investors.

By adhering to this data collection and reporting process, companies can provide investors with reliable and transparent information about their sustainability efforts, which is essential for maintaining trust and ensuring the success of sustainability-linked loans.

SLLs: Key concerns

While the prospects of SLLs are promising and hold great potential in steering us towards a more sustainable future, several key concerns require vigilant attention.

One challenge is gauging the actual ESG impact of SLLs. Measuring how this capital affects a company’s sustainability performance is complex. Emphasizing the need for “additionality” beyond standard operations is crucial for meaningful change. Also target ambition is a concern. To prevent companies from setting unambitious targets solely for margin discounts, we need to promote ambitious goals. Historical data extrapolation and industry benchmarking help align targets with realistic, achievable goals, and provides better insight into the actual impact and contribution of the SLL.

The third concern is the risk of greenwashing, where companies might make superficial claims about their sustainability achievements due to the flexibility in SLL guidelines. The Loan Market Association (LMA) is progressing toward mandatory external verification of KPI performance to counter this issue. As ESG measurements gain broader acceptance, and methods of measurement and data collection continue to advance, increased transparency will help differentiate genuine sustainability efforts from mere rhetoric.

The final concern involves aligning SLLs with evolving regulatory requirements like the EU Taxonomy for sustainable activities, SFDR ESG disclosures and CSRD. Companies frequently lack clarity regarding the investor expectations required for compliance given the many standards and frameworks available, and given the discretion that investors have over setting their own KPIs. Ensuring that selected KPIs and targets align with investor demands is crucial in addressing these challenges.

Conclusion

In conclusion, sustainability-linked loans (SLLs) represent an innovative financial instrument aligning financial interests with sustainability goals. As investors increasingly emphasise environmental, social, and governance (ESG) factors, SLLs provide a means for companies to access capital while demonstrating their commitment to sustainability. Margin ratchets, underpinned by the concepts of step-downs and step-ups, offer a unique incentive structure to drive eco-friendly practices and foster genuine change.

Successful SLL structures hinge on carefully chosen Key Performance Indicators (KPIs) and ambitious yet attainable targets. KPIs should embody specificity, measurability, verifiability, transparency, and relevance, all underpinned by credible methodologies. Achieving a balance between ambition and achievability for sustainability targets is paramount, where historical data and industry benchmarking offer valuable guidance.

However, while the potential of SLLs is promising, several key concerns warrant attention. Gauging the actual ESG impact remains a challenge, emphasising the need for “additionality” beyond standard operations. The risk of greenwashing, where sustainability claims lack substance, must be countered through mandatory external verification of KPI performance. Moreover, aligning SLLs with evolving regulatory requirements such as the EU Taxonomy and SFDR ESG disclosure is essential.

The structuring of SLLs involves negotiation and collaboration between companies and investors, with advisors playing a crucial role. Staying informed about the evolving sustainable finance regulatory landscape is vital as these principles continue to evolve in response to shifting ESG and financial market dynamics.

Any questions?

At Sustainable Capital Group, we understand the complexities of EU regulations in sustainable finance, and our sector experts are here to assist you. For personalised guidance, simply fill out our contact form, and we’ll be in touch with you shortly.