Sustainable Investment Structures: 3 alternatives to add to your portfolio

In an era where responsible investing is gaining momentum, investors are increasingly seeking opportunities that align with their values and contribute positively to the world. But how can you deploy capital in ways that drive environmental and social impact while still generating returns?

We previously looked at the core pillars of sustainability in ESG (Environmental, Social, and Governance), as well as Materiality – the ESG aspects that have the most significant influence on a company’s operations and the decisions made by stakeholders. We also did a deep-dive into sustainability-linked loans as an effective way to use your financing to incentivise sustainable business activities. In this blog post, we’ll delve into three alternative sustainable investment structures, Blended Finance, Impact Investing, and Philanthropy. Each offers a unique avenue for investors looking to make a difference.

Blended Finance: Bridging the Gap for Sustainable Projects

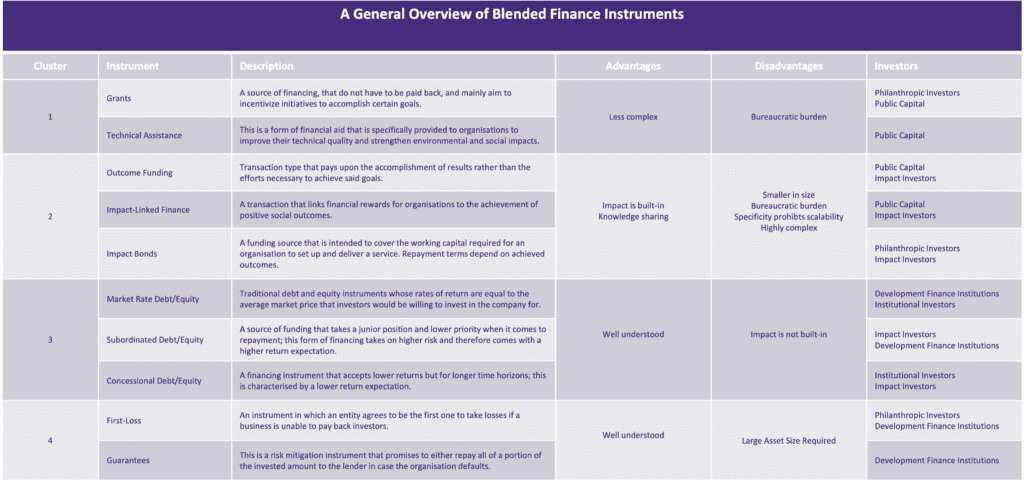

Blended finance is a dynamic approach that combines public and private capital to address the financing needs of sustainable projects that might not immediately be financially feasible from a traditional value perspective. This strategy hinges on effective collaboration between governments, central banks, development banks, institutional investors, and other financiers, each providing diverse sources of funding. The primary goal is to unlock private capital and channel it towards projects with the potential for significant positive impact by mitigating key risks.

This provides an enticing opportunity to private investors to generate both financial returns and positive impact. This not only diversifies an investor’s portfolio into new and emerging markets but also addresses growing demand for responsible and sustainable investing.

How Blended Finance Works

When it comes to Blended Finance, public capital that is often provided by governments acts as a catalyst by investing in projects aligned with strict sustainable development objectives. This ensures that private capital is directed towards impactful initiatives, ranging from nature-based projects, small scale loans in emerging economies and affordable energy solutions.

Mitigating Risks for Private Financers

Blended finance offers multiple layers of risk protection to private financers, making sustainable projects more attractive for investment. These protections include mechanisms like concessional loans, guarantees, and insurance, creating a risk/return profile that aligns with the mandates of private investors. This is particularly relevant for projects that might take a longer time to reach revenues and profitability, or in markets that are typically perceived as more risky.

What kind of projects can benefit from Blended Finance?

Blended Finance is ideal for nature-based projects, such as reforestation or alternative land-use, microfinancing and financial inclusion, affordable energy, and other projects, often focused in emerging economies.

Here’s a quick overview of each:

- Reforestation: replanting trees to restore or create forests, mitigating environmental impacts, preserving biodiversity, and combating climate change by absorbing carbon dioxide. Reforestation plays a crucial role in sustaining ecosystems, improving air and water quality, and providing habitat for wildlife.

- Alternative Land Use: unconventional or sustainable approaches to land use beyond traditional practices. This includes conservation, eco-friendly urban planning, and optimising land for both human needs and ecological resilience.

- Microfinancing: a financial practice that involves providing small-scale loans, typically to entrepreneurs in developing regions who lack access to traditional banking. Microfinancing prioritises financial inclusion and social impact, helping individuals build financial stability and improve their quality of life.

- Financial inclusion: the accessibility and availability of essential financial services, such as banking, credit, and insurance, to all segments of society, particularly those traditionally excluded or underserved. Providing marginalised communities with access to banking aims to empower these individuals.

- Affordable energy: the provision of reliable and sustainable energy sources at a cost that is reasonable and accessible to a broad population. This involves implementing technologies and practices that make energy production, distribution, and consumption economically viable for individuals and communities.

Just Transition

One distinctive feature of blended finance is its commitment to a “Just Transition”. This approach ensures that the benefits of sustainable projects are equitably shared, supporting individuals who might otherwise face economic challenges during the transition.

A Just Transition refers to an inclusive and people-centred approach to managing the shift towards a more sustainable and environmentally friendly economy.

The transition to a green economy may mean that workers in certain industries (such as the fossil fuel sector) may be socially and economically impacted. A Just Transition seeks to minimise these negative impacts according to a set of principles.

Key principles of a Just Transition include:

- Fair Employment: Ensuring that workers affected by the transition have opportunities for secure and well-paying jobs in the new green economy. This may involve retraining programs, education initiatives, and support for transitioning to new industries.

- Social Equity: Addressing the potential for increased inequality by ensuring that the benefits of the transition are distributed fairly across all communities, including those historically marginalised or disadvantaged.

- Community Engagement: Involving local communities, workers, and stakeholders in the decision-making processes related to the transition. This helps in identifying and addressing the specific needs and concerns of each community.

- Diversification of Economies: Supporting the development of alternative industries and economic activities in regions heavily dependent on industries that are in decline. This can help create a more resilient and diversified local economy.

- Environmental Justice: Ensuring that the transition does not disproportionately impact vulnerable communities and that environmental benefits are distributed equitably.

Impact Investing: Aligning Capital with Positive Change

The impact investing market has witnessed significant growth, with the Global Impact Investing Network estimating its size to be USD 1.164 trillion. Impact investing goes beyond financial returns, emphasising the intentional creation of positive social and environmental impacts through capital deployment. This growing investment approach appeals to individuals and institutions looking to align their financial goals with their values.

The Core Objectives of Impact Investing

As an impact investor you actively want to make a difference through investments. While financial returns remain important, the primary objective is to contribute to positive change. This targets companies and projects that actively seek to contribute to environmental and social issues while still aiming for competitive financial performance. Many impact investors target a “risk-adjusted” market-rate return, indicating a willingness to take on higher risk to support projects that traditional investors might overlook.

Measuring and Managing Impact

Crucial to impact investing is the measurement and management of impact. Investors often develop their own methodologies, ranging from established frameworks like the Science-Based Targets initiative to more qualitative approaches such as a Theory of Change. This ensures transparency and accountability, aligning investments with the intended positive outcomes.

3 Examples of Impact Investments

What are some examples of impact investments? From small to large-scale, we’ve underlined how 3 different sectors and cases could benefit from impact investing.

The sustainable tech startup

A venture capital fund that focuses on start-ups dedicated to developing innovative and sustainable technologies. For instance, a fund might invest in a company that creates affordable and renewable energy solutions for underserved communities.

In this scenario, the primary objective is to generate a positive social or environmental impact, such as increasing access to clean energy (see Affordable Energy above). While financial returns are still a consideration, the fund prioritises investments that align with its commitment to addressing global challenges, demonstrating the core principles of impact investing.

The nature-based solution

Another example of an impact investment could be investing in a company that specialises in developing and deploying sustainable agriculture technologies. This company might focus on precision farming methods, water conservation technologies, or organic farming practices.

The impact investment aims to support environmentally friendly and socially responsible agricultural practices, contributing to food security, reducing environmental degradation, and promoting sustainable livelihoods for farmers. The positive impact is not only measured in terms of financial returns but also in the broader context of fostering a more sustainable and resilient agricultural sector with long-term benefits for both the planet and local communities.

The healthcare helper

In this example of an impact investment, the investment would benefit a company that provides affordable and accessible healthcare solutions in underserved regions. This could include a healthcare technology start-up that develops telemedicine platforms, mobile health clinics, or diagnostic tools tailored to the specific needs of communities with limited access to traditional healthcare services.

The impact investment, in this case, aims to improve health outcomes, increase healthcare access, and address disparities in healthcare delivery. The investment contributes to both the social goal of enhancing public health and the potential for financial returns by tapping into a market with unmet needs.

Philanthropy: A Different Approach to Capital Deployment

Philanthropy involves mobilising funds from large corporates, private families, or individuals willing to contribute to impactful projects without expecting financial returns. Philanthropy seeks to have lasting effects on society by finding the root of the problem and funding projects that can generate long-term solutions by creating systemic change.

The Unique Role of Philanthropy

Philanthropic investors have lower or no return expectations, allowing them to take on more risk than traditional investors. Their goal may be to generate a cash-on-cash return or stimulate economic activity, often with a patient capital approach. While the pool of capital in philanthropy is smaller compared to other investment structures, it plays a crucial role in financing sustainable projects.

Supporting Blended Finance and Beyond

Some philanthropic funds act as guarantors or provide grants for blended finance instruments, catalysing additional private sector investment. This underscores the interconnectedness of these alternative investment structures, as philanthropy acts as a crucial catalyst for initiatives that might struggle to attract traditional investment.

Differences between Philanthropy and Charity

Philanthropy and charity are related concepts centred around providing support to various causes, but they differ in their approaches, scope, and objectives.

In essence, charity often addresses immediate needs through direct assistance, while philanthropy takes a more strategic and systemic approach to create long-term, sustainable solutions to social challenges.

Conclusion

Blended finance, impact investing, and philanthropy offer diverse opportunities for aligning capital with projects that contribute to a more sustainable and equitable world. By understanding these structures and their unique characteristics, investors can make informed decisions that not only generate returns but also create lasting positive impacts.

Any questions?

At Sustainable Capital Group, we understand the complexities of a Circular Economy and EU regulations in sustainable finance, and our sector experts are here to assist you. For personalised guidance, simply fill out our contact form, and we’ll be in touch with you shortly.